idaho state income tax capital gains

Mary must report 55000 of Idaho source income from the gain on the sale of the land computed as follows. The land in Idaho originally cost 550000.

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

The land in Utah cost 450000.

. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. ID K-1 - Idaho Partners Shareholders or Beneficiarys. The 2022 state personal income tax brackets are updated from the Idaho and Tax Foundation data.

Homelite classic basketball tournament. Idaho State Income Tax Forms for Tax Year 2021 Jan. Taxes capital gains as income and the rate is a flat rate of 495.

General Information Use Form CG to compute an individuals Idaho capital gains deduction. Therefore the taxpayers Idaho capital gains deduction is limited to the capital gain net income included in taxable income of two thousand five hundred dollars 2500 not sixty percent 60 of the capital gain net income from the qualified property. In Idaho the uppermost capital gains tax rate was 74 percent.

Inheritance and Estate Tax and Inheritance and Estate Tax Exemption. Section 63-3039 Idaho Code Rules and Regulations Publication of Statistics and Law. Days the property was used in Idaho Days the property was used everywhere.

The deduction is 100 of the capital gains from qualified Idaho properties. STATEMENT OF PURPOSE RS 11318 This bill will extend the Idaho capital gains deduction to corporations engaged in agriculture timber or mining. Idaho tax forms are sourced from the Idaho income tax forms page and are updated on a yearly basis.

100000 gain x 5500001000000 55000. The deduction is 60 of the capital gain net income included in federal taxable income from the sale of Idaho property. Idaho Capital Gains Deduction -- In General Rule 170.

Before the official 2022 Idaho income tax rates are released provisional 2022 tax rates are based on Idahos 2021 income tax brackets. Assets outlined for favorable treatment in Idaho include. Taxes capital gains as income and the rate reaches 575.

IDAPA 35 IDAHO STATE TAX COMMISSION Tax Policy Taxpayer Resources Unit 350101 Income Tax Administrative Rules. CG - Idaho State Tax Capital Gains Deduction. Idaho axes capital gains as income.

In Idaho property taxes are set at the county level. Taxidahogovindrate For years. Idaho State Income Tax Forms for Tax Year 2021 Jan.

The purpose of this legislation is to increase the exclusion from 60 to 100 effectively eliminating state assessed capital gains tax on the assets described in the existing statute. Capital gains are taxed as ordinary income in Idaho. Taxes capital gains as income and the rate is a flat rate of 323.

The rate reaches 693. Select Popular Legal Forms Packages of Any Category. While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income.

Taxes capital gains as income and the rate reaches 66. FISCAL IMPACT 66 million from the general fund. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Period requirement for capital gains purposes. All Major Categories Covered. Taxes capital gains as income and the rate is a flat rate of 495.

Taxes capital gains as income and the rate reaches 66. For tangible personal property. 1 If an individual taxpayer reports capital gain net income in determining Idaho taxable income eighty percent 80 in taxable year 2001 and sixty percent 60 in taxable years thereafter of the capital gain net income from the sale or exchange of qualified property shall be a deduction in determining Idaho taxable income.

To qualify for the exclusion the asset must have been located in Idaho at the time of sale. Deduction of capital gains. Mary must report 55000 of Idaho source income from the gain on the sale of the land computed as follows.

Statement of Purpose Fiscal Impact. Additional State Capital Gains Tax Information for Idaho. The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital gains and the marginal effect of Pease Limitations which results in a tax rate increase of 118 percent.

The combined uppermost federal and state tax rates totaled 294 percent ranking tenth highest in the nation. 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 Calculate your tax rate based upon. Download or print the 2021 Idaho Idaho Capital Gains Deduction 2021 and other income tax forms from the Idaho State Tax Commission.

Toggle navigation 2022 Federal Tax Brackets. Capital gain net income is the amount left over when you. Idaho Capital Gains Deduction.

Idaho Income Tax Brackets 2020

Historical Idaho Budget And Finance Information Ballotpedia

Idaho Income Tax Calculator Smartasset

Idaho State Tax Commission Forms Pdf Templates Download Fill And Print For Free Templateroller

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

Idaho State 2022 Taxes Forbes Advisor

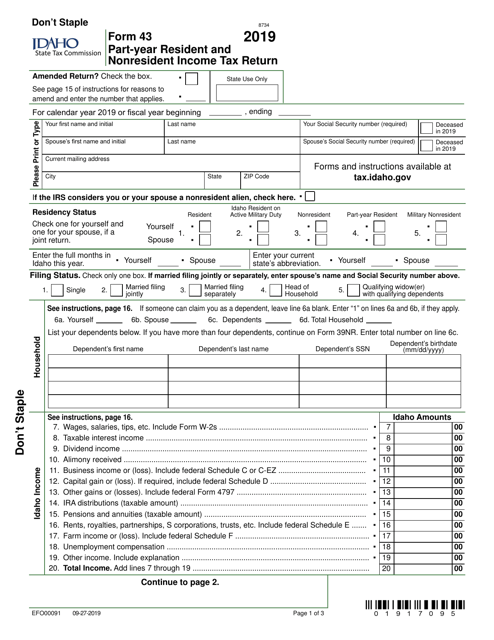

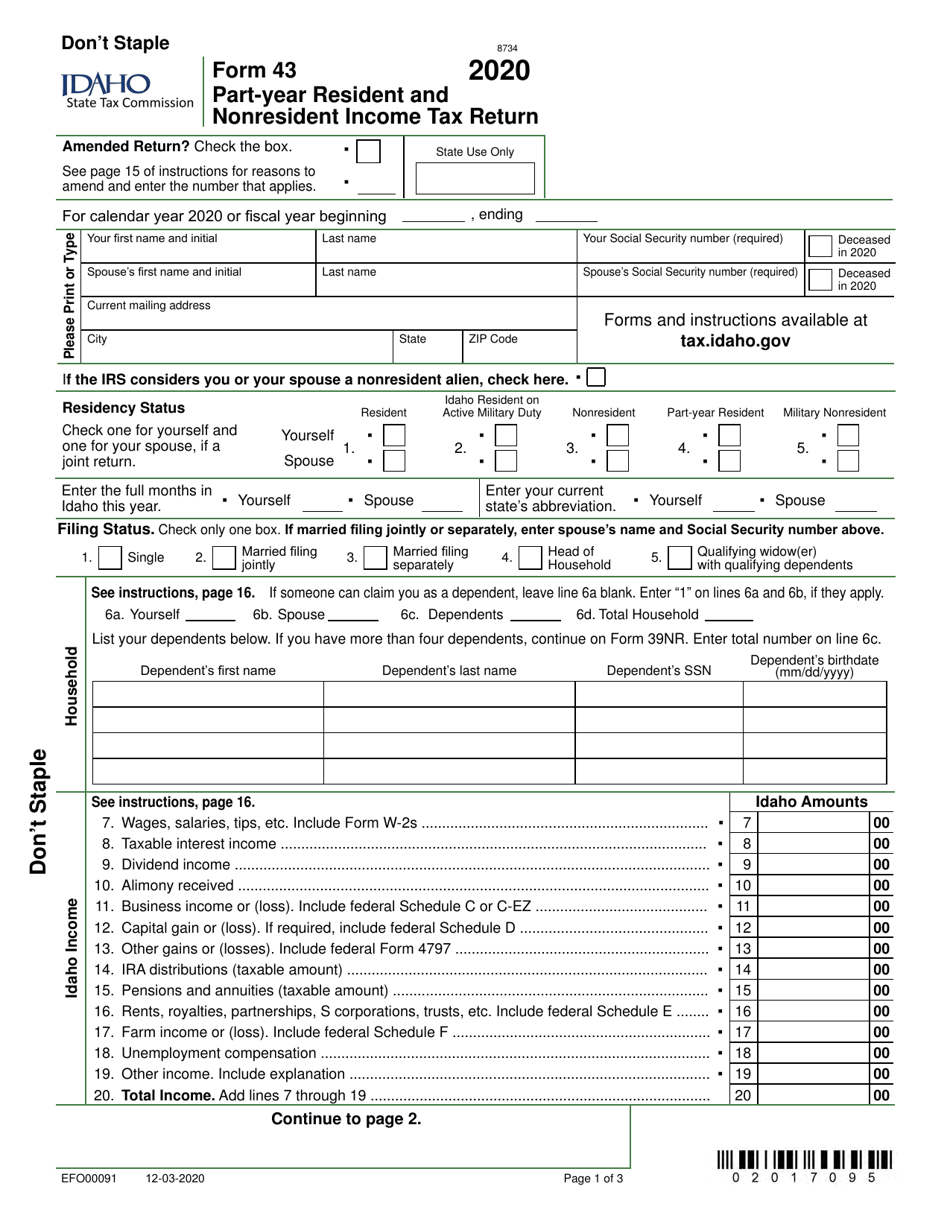

Form 43 Efo00091 Download Fillable Pdf Or Fill Online Part Year Resident And Nonresident Income Tax Return 2020 Idaho Templateroller

Cost Of Living In Idaho The True Cost To Live Here Upnest

Idaho Tax Forms And Instructions For 2021 Form 40

Taxes 1099 R Public Employee Retirement System Of Idaho

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

Prepare And E File 2021 Idaho State Individual Income Tax Return

Historical Idaho Tax Policy Information Ballotpedia